Compare Health Insurance

Whole of Market

Our Life Insurance Advisers will complete a comprehensive appraisal of the market VS your existing renewal terms for a variety of different types of term Insurance

Key Points

You will recieve Key Facts documents about any product that is recommended, as well as a details demands & needs document which will outline the advice given by the adviser

Best Deal Available

Our team of advisers will find you the best prices available on the market. In some cases, they are also able to offer bespoke terms through direct contact with Underwriting departments

Annual Appraisal

Our advisers will continue to monitor the performance of the recommended cover each year, where appropriate they will revisit the market to obtain the best terms for clients where appropriate

Comprehensive Private Medical Insurance

Standard core cover across the majority of health insurance policies will give you unlimited In & Day patient access. This is basically classed as any active treatment where a bed will be used for recovery. A budget plan will include the pre-surgical consultation, active treatment, anesthetic & after-care following the proceedure. The majority of standard policies will also include access to a range of private hospitals & some cancer cover.

Outpatient Cover

Outpatient cover classes any initial consultation or visit with a consultant where they are either diagnosing or following up from surgery. Outpatient diagnostics will also be included in your allowance. Some customers are happy to pay for outpatient costs themselves to reduce the cost of the insurance – it’s worth asking your adviser about all the options worth considering.

Hospital access

As standard, all medical insurance policies will give you access to some hospital units. However, some Hospital brands charge the insurer a premium rate for accomodation, so they may not be available on a standard list. Central London hospitals often inflate premiums by as much as 50% it’s also worth noting that customers in Scotland and Ireland can get discounts for cover through some insurer’s due to their geographically reduced access to treatment.

Additional add-ons

Therapies Cover is a popular add-on, with most Insurers allowing 10+ sessions of referred treatment for a small increase in costs.

Unlimited Cancer cover – this is quite an important aspect to consider, as it opens up additional cancer drugs not available on the NHS, it also removes some of the treatment timescale limitations associated with basic policies.

What Factors affect Private Medical Insurance?

Your Age

You are much less of a risk to an Insurer at a young age, so anyone taking cover out in their 20’s will recieve market leading premiums.

Your Health

Any pre-existing medical conditions will likely face an exclusion if you are looking at health care for the first time. Geographical access to hospitals can also impact your policy premium.

Your Lifestyle

This one may seem a little obvious, but if your overweight, smoke, drink an excessive amount or hide away from daylight you will be more likely to require medical treatment.

Your Occupation

High-risk occupations will see a load in the premium, in some circumstances cover may even be refused – this is why speaking to a specialist broker is essential to get the right advice.

Protecting your family

Our advisers are able to compare and advise on a range of Insurance including: Private medical Insurance, Life Insurance, Dental Cover, Critical Illness and Income Protection to make sure your loved ones are fully protected.

Medical Insurance

Recieve fast medical diagnosis, with appointments to suit your diary. Get access to the best consultants and recover in the highest quality of facilities available.

Income Protection

You could offer the ultimate reassurance to your staff that in the event they are unable to work, they will recieve additional Income Protection to support themselves.

Critical Illness Cover

If the unthinkable happens & you are diagnosed with a life changing condition you can be safe in the knowledge that your life expenses can be taken care of, so that you can focus on a recovery.

Life Insurance

When a person dies unexpectedly, the loss of life often has repercussions beyond just immediate family. This is especially true if the individual was a business owner or a key member of a business.

Health Insurance Buyers Guide

When buying Private Medical Insurance, getting the right cover could make a significant difference to the quality of your care and recovery following treatment.

Private Hospital List

Check the hospital list that your health insurance comes with, this will be a directory of units you can use for active treatment. Certain brands of private hospitals charge insurers more for accomodation so may not be included as standard. Some locations such as central London can be an additional cost, you may or may not need access to these private facilities.

Outpatient Cover Level

Make sure you are aware of the outpatient cover level the policy comes with, most insurers offer various packages so you need to fully understand the impact reduced outpatient cover could mean. Ask your consultant to discuss what parts of treatment come under ‘outpatient’ charges. Some customers choose to pay for all outpatient costs themselves to reduce the cost of the premium.

Cancer Cover – NICE Guidelines

Cancer cover – most policies will come with some form of cancer cover, however the most comprehensive policies will include access to drugs from overseas, groundbreaking treatment and ancillary support.

6 Week Rule/ 6 Week Option

NHS involvement – you may be offered something called a ‘6 week rule/option’ this opts you out of private treatment if the NHS can see you within 6 weeks of referral. This does offer the customer a discount of around 20-25%, however some members choose to have fully private cover and for-go the saving.

How Does Health Insurance Work?

Outpatient Cover

All health insurance claims will start with GP referral. The Patient will visit the doctor as normal and at the point of needing further investigation, a person with medical insurance will be able to ask for a private referral. Rather than waiting weeks to be seen on the NHS you will get an appointment with a private consultant much faster, at a time to suit you. This is very useful if you have a difficult, time consuming job as you can plan your appointments around your busy schedule. Outpatient is related to all initial consultations and any minior diagnostics you may need without the use of a hospital bed.

Daypatient Cover

Daypatient refers to any diagnostics or minor treatment that requires the use of a hospital bed for just the day. This could be very straight forward surgery with minimal recovery period or significant dianostic tests. Most health insurance policies will cover these aspects in full, but do check with your policy cover level and discuss this with your dedicated insurance specialist.

Inpatient Cover

As the name suggests, inpatient refers to treatment and charges related to overnight stays. This is normally significant medical treatment that may last for a long period of time.

Extended Cancer Cover

With nearly all modern private health insurance plans, you get extended cancer cover. This usually removes time limits on cancer treatment, gives the patient access to expensive cancer drugs not available on the NHS and can offer brand new experimental treatments.

Speak to one of our advisers today

Get in touch with one of our health insurance expertcs immediately or schedule an appointment to suite you.

Why do i need Private Medical Insurance?

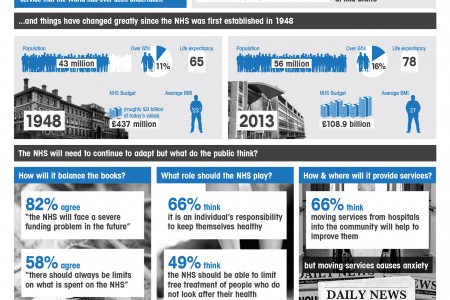

Medical Insurance can be suitable for such a wide range of customers from every walk of life. Originally Private Medical Insurance was designed as an alternative to the NHS. Since then, waiting times have increased, surgery cancellations are all more common and significant proven drugs have been removed from the NICE guidelines list for affordable medications. Private Medical Insurance is designed for customers who want choice and control over their treatment. In most cases, patients can choose where they have treatment, they can have a good choice of consultants and can decide when treatment takes place – this is why it’s such a popular benifit to offer employees as it can fit in around a busy working life.

It’s also worth mentioning that there has never been a case of a superbug (like MRSA) at a private unit. Facilities are of a very high standard and staff are very attentive.

There have also been situations where the NHS have refused treatment for a patient, only for them to then go on and pay for the proceedure privately and make a good recovery.

The NHS is a fantastic service that we are very fortunate to have, however it can become a lottery when it comes to maintaining appointments and being seem promptly – this however can be worse in some areas of the UK than others – so do check out local services around you before making a desision.

How much does Health Insurance Cost?

Medical insurance increases in cost with age. Customers who are older, pose a greater risk to an Insurer because they are more likely to need treatment.

That being said, there are ways to reduce the cost of medical insurance if you shop around the market & consider removing parts of cover that you may not deem ‘essential’

No outpatient cover – We have touched on this already, statistically the majority of claims an Insurer faces are outpatient consultations, with the majority of these not leading to any active treatment. It’s all the process overheads that makes these claims expensive. If you are prepared to reduce or remove the level of outpatient cover, this will significantly reduce your premiums.

Reduced hospital lists – Ask your adviser for a detailed breakdown of hospitals available on certain lists. Your favourite local hospital may well appear on a cheaper list, so by changing hospital group access you may reduce your costs without changing access to that unit.

Excess – Some Insurers offer bigger discounts for applied excesses than others – make sure to play around with the ratios of each to find the best deal.

6 Week Rule – some Insurers will offer up to a 25% discount if you are willing to use the NHS for fast treatment, there are however some pitfalls associated with this option so make sure you fully understand the implications of it.