Do I need Income Protection Insurance?

Whole of Market

Our Income Protection Advisers will complete a comprehensive appraisal of the whole market, explaining how the product works, it’s benefits and pitfalls & recommendations

Key Points

You will recieve Key Facts documents about any product that is recommended, as well as a details demands & needs document which will outline the advice given by the adviser

Best Deal Available

Our team of advisers will find you the best prices available on the market. In some cases, they are also able to offer bespoke terms through direct contact with Underwriting departments

Annual Appraisal

Our advisers will continue to monitor the performance of the recommended cover each year, where appropriate they will revisit the market to obtain the best terms for clients where appropriate

How does Income Protection Insurance work?

Short term Income Protection Insurance

Short-term Income Protection policies, which are otherwise known as Accident, Sickness and Unemployment (ASU) products, will generally only pay out for one or two years

Long term Income Protection Insurance

Long term Income Protection, these will usually provide a regular income if you are unable to work due to illness or disability until you are well enough to return to work, or until the end of the policy term.

What Factors Affect Income Protection Insurance Prices?

Your Age

You are much less of a risk to an Insurer at a young age, so anyone taking cover out in their 20’s will recieve market leading premiums.

Your Health

Any pre-existing medical conditions will likely face an exclusion and an increase in overall policy cost – so take cover out when you are issue-free if possible

Your Lifestyle

This one may seem a little obvious, but if your overweight, smoke, drink an excessive amount or hide away from daylight you will be more likely to die early.

Your Occupation

High-risk occupations will see a load in the premium, in some circumstances cover may even be refused – this is why speaking to a specialist broker is essential to get the right advice.

Protecting your family and Staff

Our advisers are able to compare and advise on a range of Insurance including: Private medical Insurance, Life Insurance, Dental Cover, Critical Illness and Income Protection to make sure your loved ones are as cared for as possible.

Medical Insurance

Recieve fast medical diagnosis, with appointments to suit your diary. Get access to the best consultants and recover in the highest quality of facilities available.

Income Protection Insurance

You could offer the ultimate reassurance to your staff that in the event they are unable to work, they will recieve additional Income Protection to support themselves.

Critical Illness Cover

If the unthinkable happens & you are diagnosed with a life changing condition you can be safe in the knowledge that your life expenses can be taken care of, so that you can focus on a recovery.

Life Insurance

When a person dies unexpectedly, the loss of life often has repercussions beyond just immediate family. This is especially true if the individual was a business owner or a key member of a business.

Do i need income Protection Insurance?

According to the ABI, one million workers a year find themselves unable to work due to a serious illness or injury.

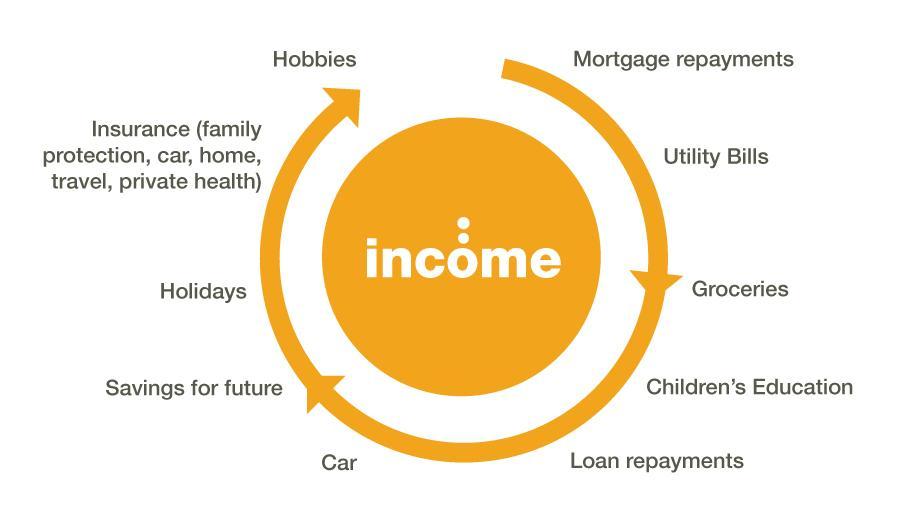

It doesn’t matter whether or not you have children or other dependants – if illness would mean you couldn’t pay the bills, you should consider income protection insurance.

You’re most likely to need it if you’re self-employed or employed and you don’t have sick pay to fall back on.

Check what your employer will provide for you if you’re off sick.

Putting an appropriate income protection plan in place will provide you with the peace of mind of knowing that income is available for you to live off in the event of you bein unable to work.

How much does Income Protection Cost?

The costs of taking out income protection insurance are affected by the following things:

- your age. The older you are when you take out the policy, the more you are likely to pay, as your risk of getting ill increases

- your sex. Men make slightly more claims than women, so may pay more

- your health. If you’re in good health, you will pay less to insure yourself

- your job. If you do a risky job, you will pay more for cover

- hobbies and lifestyle. If you take part in dangerous hobbies or you smoke or drink heavily, you will pay more for cover.

- the waiting period The longer you can wait before you make a claim, the cheaper your premiums will be

- whether you might be prepared to do other kinds of work than your own if you get ill. It usually costs less to take out income protection insurance if you say you will only make a claim if you are unable to do any work at all, rather than just your own job.

For an accurate illustration of costs, please get in touch with one of our trained advisers.

Speak to one of our advisers today

Get in touch with one of our Business Specialists immediately or schedule an appointment to suite you