What Factors Affect Life Insurance Prices?

Your Age

You are much less of a risk to an Insurer at a young age, so anyone taking cover out in their 20’s will recieve market leading premiums.

Your Health

Any pre-existing medical conditions will likely face an exclusion and an increase in overall policy cost – so take cover out when you are issue-free if possible

Your Lifestyle

This one may seem a little obvious, but if your overweight, smoke, drink an excessive amount or hide away from daylight you will be more likely to die early.

Your Occupation

High-risk occupations will see a load in the premium, in some circumstances cover may even be refused – this is why speaking to a specialist broker is essential to get the right advice.

Why do i need Life Insurance?

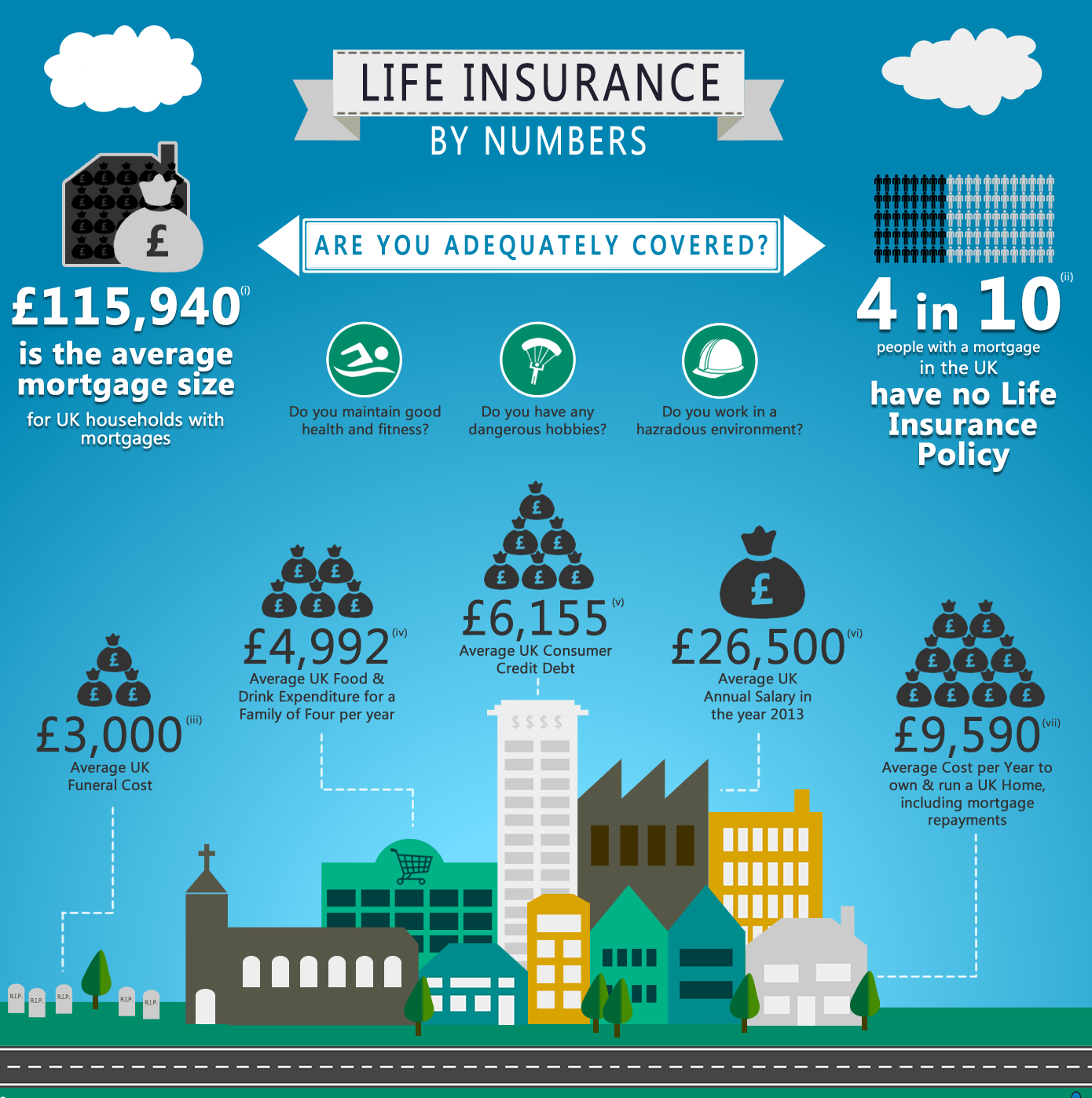

If you have dependants – such as school age children, a partner who relies on your income or a family living in a house with a mortgage that you pay – a life insurance policy can provide for them if you die.

There are various different types of life insurance. The most common is level term insurance, which pays out a fixed amount if you die within the policy term. You can also buy decreasing term insurance, where the pay-out gets gradually smaller.

Decreasing term insurance is often linked to a repayment mortgage as the amount you owe the lender also reduces over time.

Family income benefit pays out an agreed monthly income (from the date of the claim to the end of the policy term) instead of a lump sum.

Whole-of-life cover is usually the most expensive as there is no actual finite term. In other words, the policy lasts as long as you do, so is guaranteed to pay out.

How much does Life Insurance Cost?

When buying life insurance, you need to consider not just how much cover you need, but under what circumstances you want it to pay out. Also, you need to think about whether you want money paid as a lump sum or gradually.

Calculating how much cover you need is difficult. You’ll want to repay the mortgage, but what about school or university fees?

As a general rule, the younger you are when you take out the cover, the cheaper it will be. A 20 year old, with no pre-existing medical issues should pay roughly £5-£10 per month for a payout of around £100k, if you double the payout, so will the monthly premium.

If you are older when starting cover, the risk associated will increase significantly, what’s more any existing medical issues may face exclusions or policy price increases – best to get advice from a trained adviser who can find you the best deal and underwriting terms. Often the cheapest policy is not the best. It would also be worth checking payout rates for each Insurer.

Major factors in all health related insurance products are weight, lifestyle, smoking, exersise, alcohol consumption and pre-existing medical history.

Life insurance needs to be set up right, you wont be there to argue a claim so it’s essential to get proper advice now to make sure you have the cover you expect. If you already have life insurance, there is no reason not to get a new quote comparison – we may be able to reduce your premiums, increase your benifits or even remove medical exclusions.

Speak to one of our advisers today

Get in touch with one of our Business Specialists immediately or schedule an appointment to suite you