Cheap life insurance

Whole of Market

Our Life Insurance Advisers will complete a comprehensive appraisal of the market VS your existing renewal terms for a variety of different types of term Insurance

Key Points

You will recieve Key Facts documents about any product that is recommended, as well as a details demands & needs document which will outline the advice given by the adviser

Best Deal Available

Our team of advisers will find you the best prices available on the market. In some cases, they are also able to offer bespoke terms through direct contact with Underwriting departments

Annual Appraisal

Our advisers will continue to monitor the performance of the recommended cover each year, where appropriate they will revisit the market to obtain the best terms for clients where appropriate

Compare Life Insurance

Choose a monthly figure that you can afford

Premiums can start from as little as £5 per month for cheap life insurance. Premiums do not normally increase in cost unlike other insurance polices.

Confirm how long you want the cover for

Most people will take out cover for as long as possible, however some customers may only need to cover the family until their children leave home or the mortgage is paid off.

Decide on the payout amount you want

Make sure to include all major costs that your family would face, including the mortgage balance, cost of living, any financial liabilities you may have plus perhaps tuition fees for University.

What Factors Affect Life Insurance Prices?

Your Age

You are much less of a risk to an Insurer at a young age, so anyone taking cover out in their 20’s will recieve market leading premiums.

Your Health

Any pre-existing medical conditions will likely face an exclusion and an increase in overall policy cost – so take cover out when you are issue-free if possible

Your Lifestyle

This one may seem a little obvious, but if your overweight, smoke, drink an excessive amount or hide away from daylight you will be more likely to die early. Cheap life insurance is offered to members who pose the lowest risk.

Your Occupation

High risk occupations will see a load in the premium, in some circumstances cover may even be refused – this is why speaking to a specialist broker is essential to get the right advice.

Protecting your family

Our advisers are able to compare and advise on a range of Insurance including: Private medical Insurance, Life Insurance, Dental Cover, Critical Illness and Income Protection to make sure your loved ones are looked after.

Medical Insurance

Recieve fast medical diagnosis, with appointments to suit your diary. Get access to the best consultants and recover in the highest quality of facilities available.

Income Protection

You could offer the ultimate reassurance to your staff that in the event they are unable to work, they will recieve additional Income Protection to support themselves.

Critical Illness Cover

If the unthinkable happens & you are diagnosed with a life changing condition you can be safe in the knowledge that your life expenses can be taken care of, so that you can focus on a recovery.

Life Insurance

When a person dies unexpectedly, the loss of life often has repercussions beyond just immediate family. This is especially true if the individual was a business owner or a key member of a business.

Life Insurance Comparison

Here are some essential tips to remember when choosing your own life insurance cover:

Make sure you choose an approriate payout value based on your own circumstances, this includes any liabilities you would leave behind such as a mortgage, the cost of living of any dependants plus perhaps an emergency lump sum for your loved ones

Cover Period

Decide how long to have cover for, some customers only want cover to exist whilst children remain dependant, others will link this in with the time remaining on the mortgage.

Payout Type

Make sure you understand the type of payout you are choosing – some will offer a flat rate, others will decrease in line with the policy duration.

Members

Do you have everyone covered? consider joint life insurance as this could be cheaper that two separate policies.

Small Print

Be aware of any policy exclusion – are these the best underwriting terms available on the market? different insurers have different terms.

Budget vs Comprehensive

Cheap life insurance is not always the best option, make sure you understand the limitations or terms of the cover.

Non-Disclosure

Be honest and clear with your answers. Any non-disclosure could result in a policy being completely void – You wont be around to argue with the insurer so get everything set up right from the start.

Competitive Cover

Is your current policy competitive? are you looking for additional cover? If so, book an appointment with one of our Independant advisers to talk through your best options.

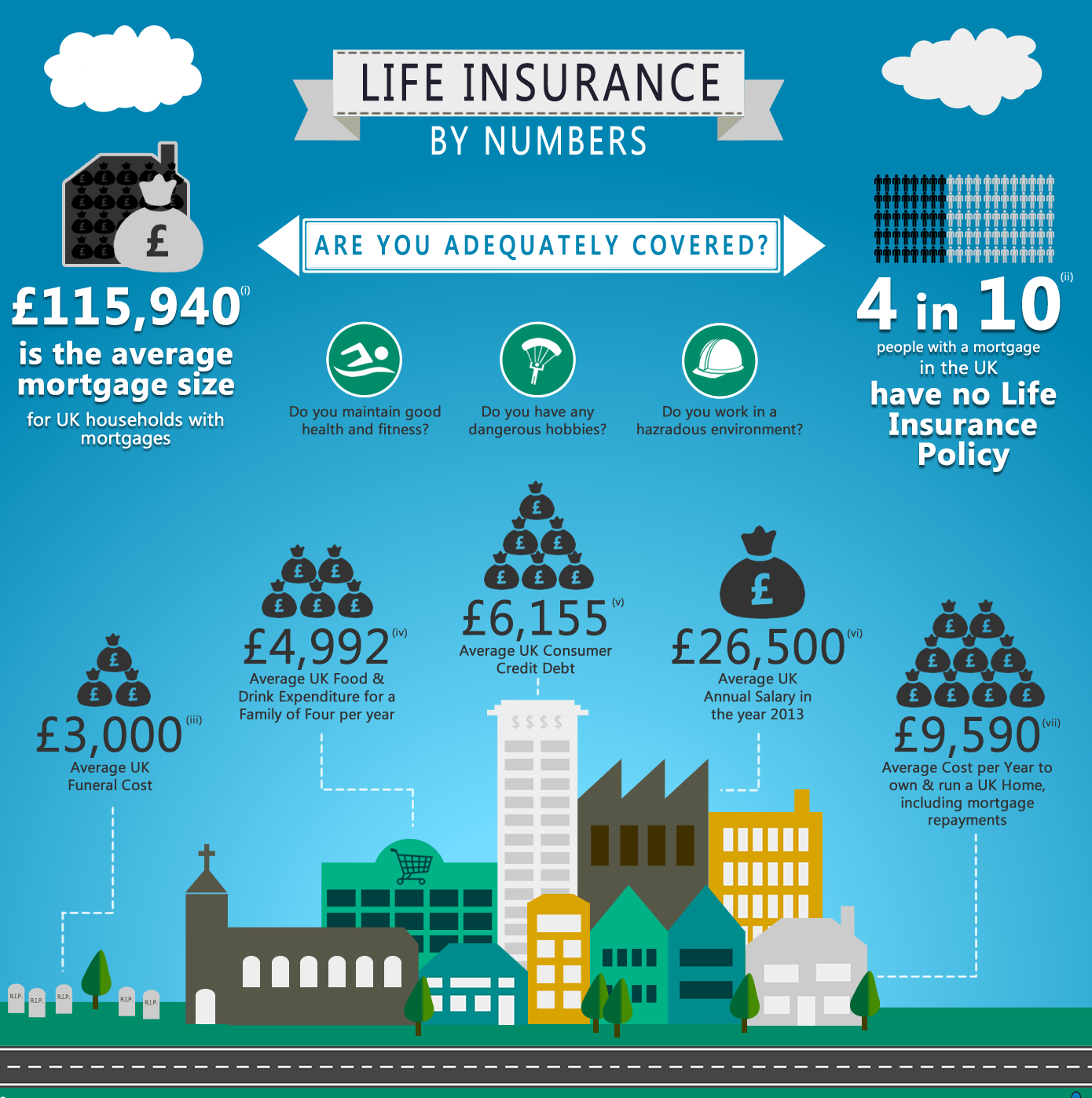

Why do i need Life Insurance?

If you have dependants – such as school age children, a partner who relies on your income or a family living in a house with a mortgage that you pay – a life insurance policy can provide for them if you die.

Types of Life Insurance

There are various different types of life insurance. The most common is level term insurance, which pays out a fixed amount if you die within the policy term. You can also buy decreasing term insurance, where the pay-out gets gradually smaller.

Decreasing term insurance is often linked to a repayment mortgage as the amount you owe the lender also reduces over time.

Family income benefit pays out an agreed monthly income (from the date of the claim to the end of the policy term) instead of a lump sum.

Whole-of-life cover is usually the most expensive as there is no actual finite term. In other words, the policy lasts as long as you do, so is guaranteed to pay out.

Cheap life insurance may not give you a large enough payout to cover the biggest overheads such as a mortgage balance.

How much does Life Insurance Cost?

When buying life insurance, you need to consider not just how much cover you need, but under what circumstances you want it to pay out. Also, you need to think about whether you want money paid as a lump sum or gradually.

Calculating how much cover you need is difficult. You’ll want to repay the mortgage, but what about school or university fees?

Get started young

As a general rule, the younger you are when you take out the cover, the cheaper it will be. A 20 year old, with no pre-existing medical issues should pay roughly £5-£10 per month for a payout of around £100k, if you double the payout, so will the monthly premium. If you want cheap life insurance, it’s best to start cover as yound as possible when you pose the lowest risk to an insurer.

Pre-existing medical history

If you are older when starting cover, the risk associated will increase significantly, what’s more any existing medical issues may face exclusions or policy price increases – best to get advice from a trained adviser who can find you the best deal and underwriting terms. Often the cheapest policy is not the best. It would also be worth checking payout rates for each Insurer.

Major factors in all health related insurance products are weight, lifestyle, smoking, exersise, alcohol consumption and pre-existing medical history.

Life insurance needs to be set up right, you wont be there to argue a claim so it’s essential to get proper advice now to make sure you have the cover you expect. If you already have life insurance, there is no reason not to get a new quote comparison – we may be able to reduce your premiums, increase your benifits or even remove medical exclusions.

Speak to one of our advisers today

Get in touch with one of our Business Specialists immediately or schedule an appointment to suite you